What’s a Tax Invoice – Everything Freelancers and SMEs Need to Know

Published: November 8, 2025

Summary: A tax invoice is a legal document that records a sale and shows the amount of tax charged. For freelancers and SMEs, it’s not just paperwork — it’s proof of business transactions, tax compliance, and professionalism. This guide explains what a tax invoice is, what it must include, and how to create one instantly using Invozee.

Create Your Tax Invoice FreeWhat is a tax invoice?

A tax invoice is an official record issued by a supplier to the buyer, showing details of the transaction and the amount of tax payable. It’s used to claim tax credits, comply with government regulations, and ensure accurate bookkeeping.

Why tax invoices matter

Whether you’re a freelancer in design, consulting, or IT — or an SME providing services — a tax invoice validates your transaction. It protects your business by documenting what was sold, how much tax was collected, and to whom.

Key components of a tax invoice

- Supplier’s business name, address, and tax registration number

- Customer’s name and address

- Invoice number and issue date

- Tax rate (GST, VAT, or Sales Tax)

- Itemized description of goods or services

- Total amount before and after tax

- Payment terms and due date

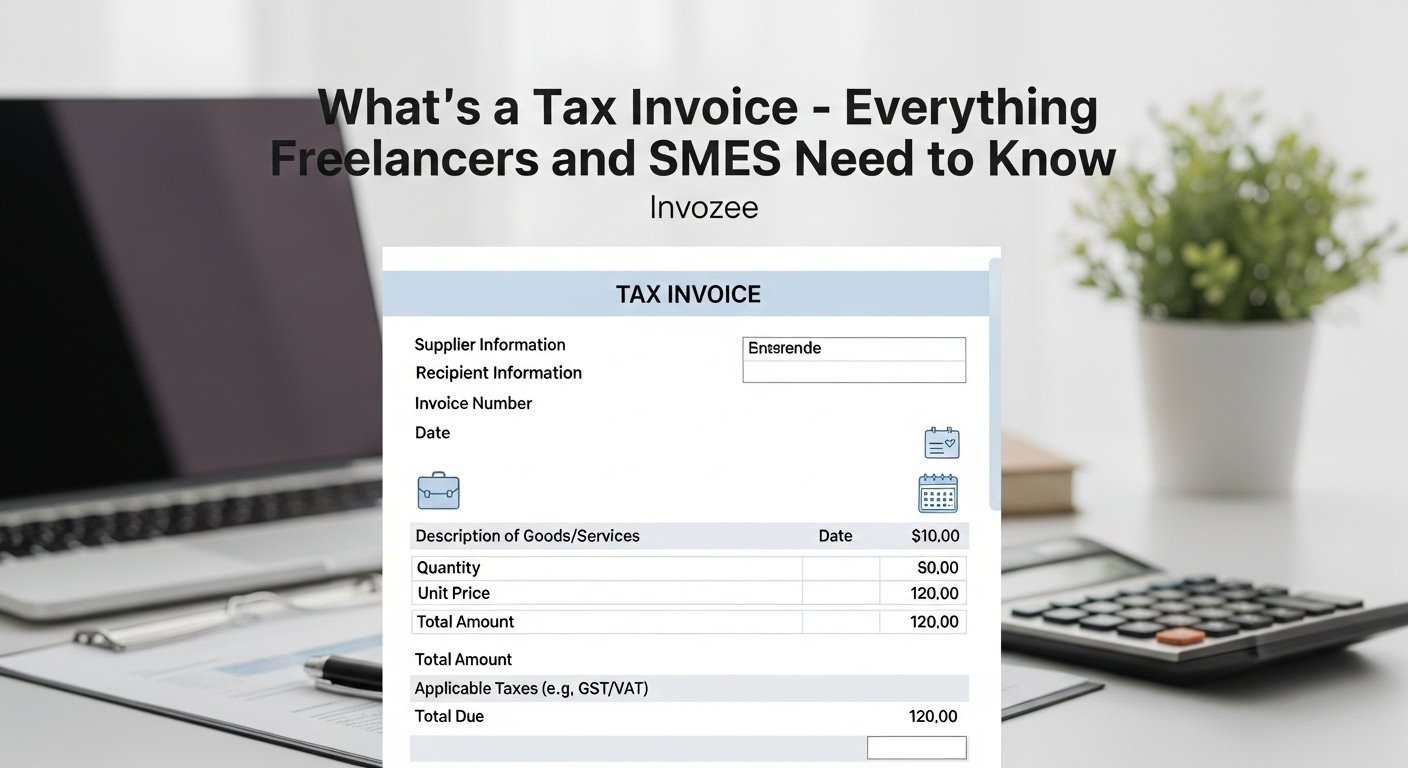

Example format of a tax invoice

Here’s how a simple tax invoice might look for freelancers or small businesses:

How to generate a tax invoice online

- Open Invozee – it’s free and no signup required.

- Enter your business and client details.

- Add line items, taxes, and payment terms.

- Preview the layout and download your PDF instantly.

Want to make it even easier? Save your logo and contact info once and reuse it next time — Invozee keeps it simple for freelancers and SMEs.

Tax invoice vs regular invoice

Not all invoices are tax invoices. A tax invoice must include your tax registration and the amount of tax charged. A regular invoice may skip that if you’re not registered for GST or VAT.

To understand the distinction, check out our article on Invoice vs Receipt.

Other helpful invoice types

Depending on your business, you might also use:

- Freelance Invoice – for one-time projects.

- Free Invoice Templates – to get started quickly.

- Proforma or open invoices – for quotations before the final billing.

Tools that help you stay on top of invoices

Use FormatPilot for formatting and documentation consistency. Combine it with DueSignal to get reminders and automate client follow-ups — and keep everything synced with Invozee.

Frequently asked questions

What’s the purpose of a tax invoice?

It acts as official proof of sale and ensures compliance with tax authorities while allowing clients to claim tax credits.

Can I create a tax invoice manually?

Yes, but it’s time-consuming. Using Invozee automates tax fields and ensures compliance formatting for every invoice you send.

What’s the difference between a GST and a VAT invoice?

Both are types of tax invoices. The terminology depends on your country’s tax system — GST in India, VAT in the EU and UK.

Can Invozee generate tax invoices with multiple currencies?

Absolutely. You can select your preferred currency and tax rate before generating the PDF.

Final thoughts

A tax invoice shows your professionalism and keeps you compliant. Whether you’re managing clients locally or internationally, Invozee lets you create and download tax invoices in minutes — no design skills or registration required.