What Is an Itemized Invoice and How to Create One

A good invoice does more than show a final number. It tells the story of what you delivered. An itemized invoice makes that story explicit by breaking charges into clear, understandable line items. That way, your client, their bookkeeper, and even future you can quickly understand what was billed and why.

Let’s walk through what counts as an itemized invoice, where itemized billing is most useful, and how to structure your line items so they are detailed enough to be helpful but not so detailed that they become confusing.

Key takeaways

- An itemized invoice breaks your charges into clear line items with descriptions, quantities, unit prices, and totals.

- Itemized billing reduces disputes, speeds approvals, and makes tax and accounting much easier.

- You do not need to list every tiny action, but you should group work into meaningful, understandable chunks.

- Invozee helps you create reusable itemized templates, so you do the thinking once and reuse it with each invoice.

- This guide is for workflow ideas only and not tax or legal advice.

What is an itemized invoice?

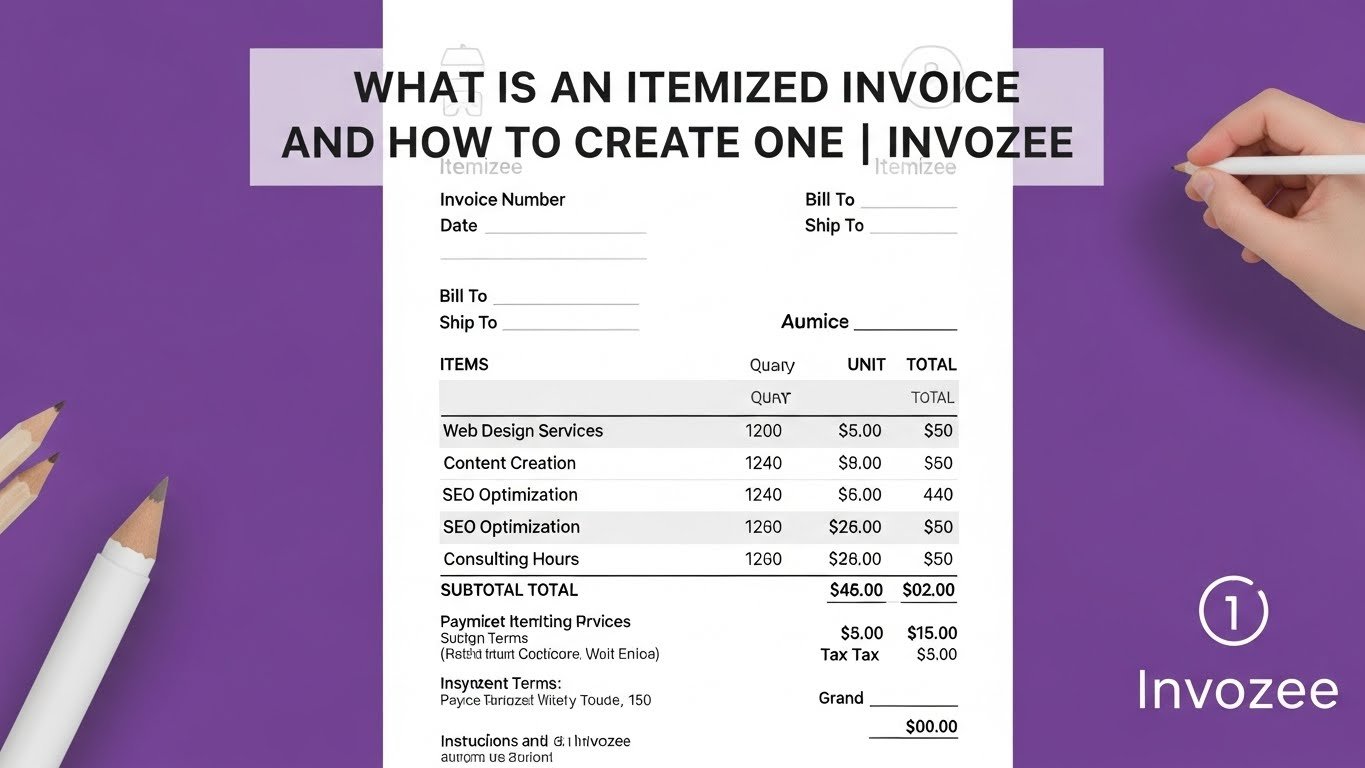

An itemized invoice is a detailed invoice that lists each product or service you are charging for on separate lines. Each line item usually includes:

- A short description of the product or service.

- The quantity or hours.

- The unit price or rate.

- The line total (quantity multiplied by unit price).

- Optionally, tax or discounts related to that line.

The alternative is a very simple invoice with one flat line, such as “Consulting services – $3,000”. That can work for some situations, but when clients want to understand the breakdown—or when regulations require more detail—itemized billing is the better option.

Why itemized billing matters

Itemized invoices are not just “nice to have”. They solve several real problems for you and your clients.

Key reasons to itemize your invoices

- Clarity for clients: Clients can see what they are paying for and compare it with your proposal or contract.

- Fewer disputes: Detailed line items reduce back and forth because questions are often answered in the invoice itself.

- Better internal records: You can quickly see what was delivered in a given period without rereading old project notes.

- Easier accounting and tax: Bookkeepers and tax professionals often prefer itemized documentation for audits and deductions.

- Stronger perceived value: Breaking a project into meaningful pieces helps clients see the effort behind the final number.

Many official tax and business resources highlight the importance of keeping detailed, understandable records. A good itemized invoice contributes directly to that paper trail, alongside receipts and other supporting documents. When you combine this with the concepts in our invoice vs receipt guide, you have a much clearer picture of your financial documentation.

What to include in an itemized invoice

The overall structure of an itemized invoice looks a lot like any other invoice. The difference is that the line items section does more of the heavy lifting.

Core sections of an itemized invoice

- Your information: Business name, contact details, and any registration or tax IDs.

- Client information: Client or company name, contact person, and address.

- Invoice details: Invoice number, issue date, due date, and payment terms.

- Itemized line items: A breakdown of what you are charging for.

- Totals: Subtotal, taxes, discounts, and final amount due.

- Payment instructions: How and where the client should pay.

What goes in each line item

A strong itemized invoice does not list every mouse click, but it does break work into clear categories. For each line, aim to include:

- Description: A short phrase or sentence that your client will recognise.

- Quantity or hours: For example, “10 hours”, “3 units”, or “1 package”.

- Unit price or rate: Your hourly rate or price per unit.

- Line total: The result of quantity x price.

- Tax / discount (if relevant): If an item is taxed differently or discounted, make that clear.

If you are moving from a basic invoice format to a more detailed style, it can help to start from a template. Our free invoice templates for 2025 article gives several layout ideas you can adapt for itemized billing and rebuild inside Invozee.

Examples of itemized invoices in different businesses

It is easier to understand itemized invoices when you see how they differ from one business type to another.

Freelance designer

- Brand discovery workshop – 4 hours x hourly rate

- Logo concept and revisions – fixed fee

- Website layout design – fixed fee

- Additional revisions – 3 hours x hourly rate

Consultant or coach

- Strategy session – 2 sessions x 90 minutes

- Follow-up report and action plan – flat fee

- Email support – 5 hours x hourly rate

Service business (e.g. cleaning)

- Office cleaning – 4 visits x 2 hours

- Deep clean – 1 visit x fixed fee

- Supplies and materials – list of products with units

Product-based business

- Product A – 10 units x unit price

- Product B – 4 units x unit price

- Shipping and handling – flat fee

If you are a freelancer or contractor, you will see a lot of overlap with our invoice for freelancers article, which talks more about naming your services and describing them clearly for clients.

UX tips for readable line items

An itemized invoice is still part of your user experience. You do not just want detail—you want detail that is easy to scan.

Use consistent naming

Name your line items the same way you name services on your website or proposal. If your sales page says “Website care plan”, use that phrase on the invoice instead of a vague label like “Support”.

Group related items

If you have many lines, consider grouping them visually or logically. For example, group “Design” items together and “Development” items together, rather than mixing them randomly.

Keep descriptions short but specific

A brief sentence is usually enough. You can always include a reference to a proposal, contract, or statement of work for deeper detail (for example, “Scope per Proposal #2025-03”).

Highlight the totals

Even with detailed line items, the client still needs to see the main numbers quickly. Make sure your subtotal, tax, and total due are visually easy to spot. This is one of the small UX touches that guides from resources like HubSpot often emphasise when discussing effective invoices.

Creating itemized invoices in Invozee

Invozee is built to help you create clean, reusable invoice templates. That is exactly what you need if you plan to itemize your billing regularly.

Turn your usual work into line items

Start by listing your most common services or products. For each, decide:

- What you will call the line item.

- Whether you charge per hour, per unit, or per package.

- Any standard notes, such as “Includes up to two revision rounds”.

Then, set these up inside Invozee so you can add them to any invoice in a few clicks rather than typing them every time.

Create templates for different scenarios

You can have separate itemized invoice templates for:

- Project-based work with phases (discovery, design, build, launch).

- Monthly service packages with add-ons.

- Product orders with shipping and handling lines.

This approach builds on the ideas in our free invoice templates article, but tailored specifically to itemized billing in your own business.

Keep a clear history of itemized invoices

Once your templates are in place, Invozee helps you:

- See which itemized invoices are paid, outstanding, or overdue.

- Review past invoices to see what you charged for similar projects.

- Respond quickly when clients or accountants ask for old documentation.

Make every invoice a clear story of your work

Itemized invoices help clients understand your value and pay with confidence. With Invozee, you can turn your usual services into reusable line items and send clean, detailed invoices in just a few clicks.