Valid Tax Invoice Checklist — Ensure Your Invoices Are Compliant

Published: December 30, 2025

Summary: Follow our detailed checklist to ensure your tax invoices meet all legal requirements. Download a free tax invoice template to get started with your compliant invoices.

Creating a valid tax invoice is crucial for both businesses and customers. A tax invoice is required to prove that a transaction has taken place and to substantiate the taxes that have been paid. Ensuring your invoices meet legal and tax standards is essential for smooth business operations. In this blog, we’ll provide a checklist to help you create compliant tax invoices every time.

What Makes an Invoice Valid for Tax Purposes?

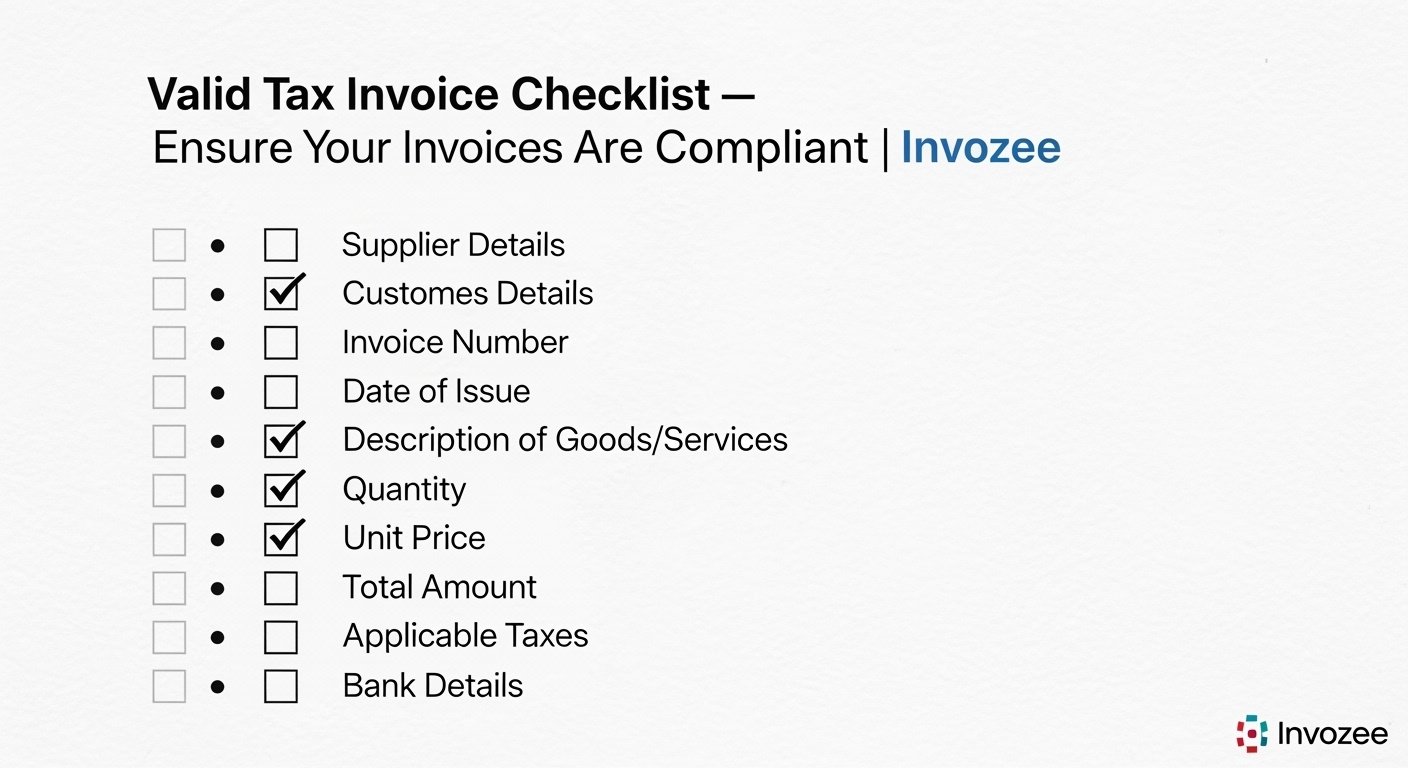

A tax invoice must include certain details to be legally valid and comply with tax regulations. Without these essential details, your invoice may be rejected or delayed by tax authorities. Here’s a checklist to ensure your invoice is valid for tax purposes:

Valid Tax Invoice Checklist

- Business Information: Include your business name, address, and tax identification number (TIN).

- Customer Information: Include the customer’s name, address, and tax identification number (if applicable).

- Invoice Number: Every invoice should have a unique number to track it.

- Invoice Date: The date the invoice is issued should be clearly stated.

- Description of Goods or Services: List each item or service provided with enough detail to explain the transaction.

- Unit Price: Include the price per item or service unit before tax.

- Total Amount: The total amount due, including taxes and discounts, must be shown clearly.

- Tax Rate: The applicable tax rate(s) must be stated clearly, along with the total tax amount.

- Payment Terms: Specify payment due dates and terms (e.g., 30 days after the invoice date).

- Tax Authority Details: Include any relevant tax authority information if required by your jurisdiction.

Why a Valid Tax Invoice Is Important

A valid tax invoice serves as proof of the transaction, both for accounting purposes and for tax reporting. It ensures that the appropriate taxes are collected, helps avoid audits, and is essential for any tax claims. For businesses, issuing a tax-compliant invoice is crucial for legal and financial reasons.

How to Create a Valid Tax Invoice Online

Creating a valid tax invoice is easy with Invozee. Here’s how:

- Sign up or log in to Invozee.

- Enter your business and customer details.

- List the services or products provided, along with the prices and applicable tax rates.

- Ensure the invoice includes all the required tax information.

- Generate and download your tax invoice as a PDF, ready to send to your client.

Free Tax Invoice Template

You can download a free tax invoice template from Invozee to ensure your invoices are always compliant with tax regulations.

Best Practices for Tax Invoices

- Be Consistent: Always include the same information on your invoices to maintain uniformity and avoid confusion.

- Stay Updated: Regularly check tax laws and regulations to ensure your invoices comply with the latest requirements.

- Use Invoicing Software: Use invoicing software like Invozee to automate the process and reduce errors.

Frequently Asked Questions

Can I create a tax invoice using a simple invoice template? No, a tax invoice must include specific information, such as tax rates and your business’s tax identification number.

What should I do if I make an error on a tax invoice? If you make an error, issue a corrected invoice (also called a credit note or a revised invoice) to replace the incorrect one.

Can I issue a tax invoice for services? Yes, tax invoices can be issued for both products and services as long as the necessary tax information is included.

Start creating your tax-compliant invoices with Invozee today.