Is a Commercial Invoice the Same as a Tax Invoice?

Many business owners ask the same question when they start shipping overseas. Is a commercial invoice the same as a tax invoice, or can one document cover both. It feels like paperwork overload when you already have orders to fulfil and clients to serve.

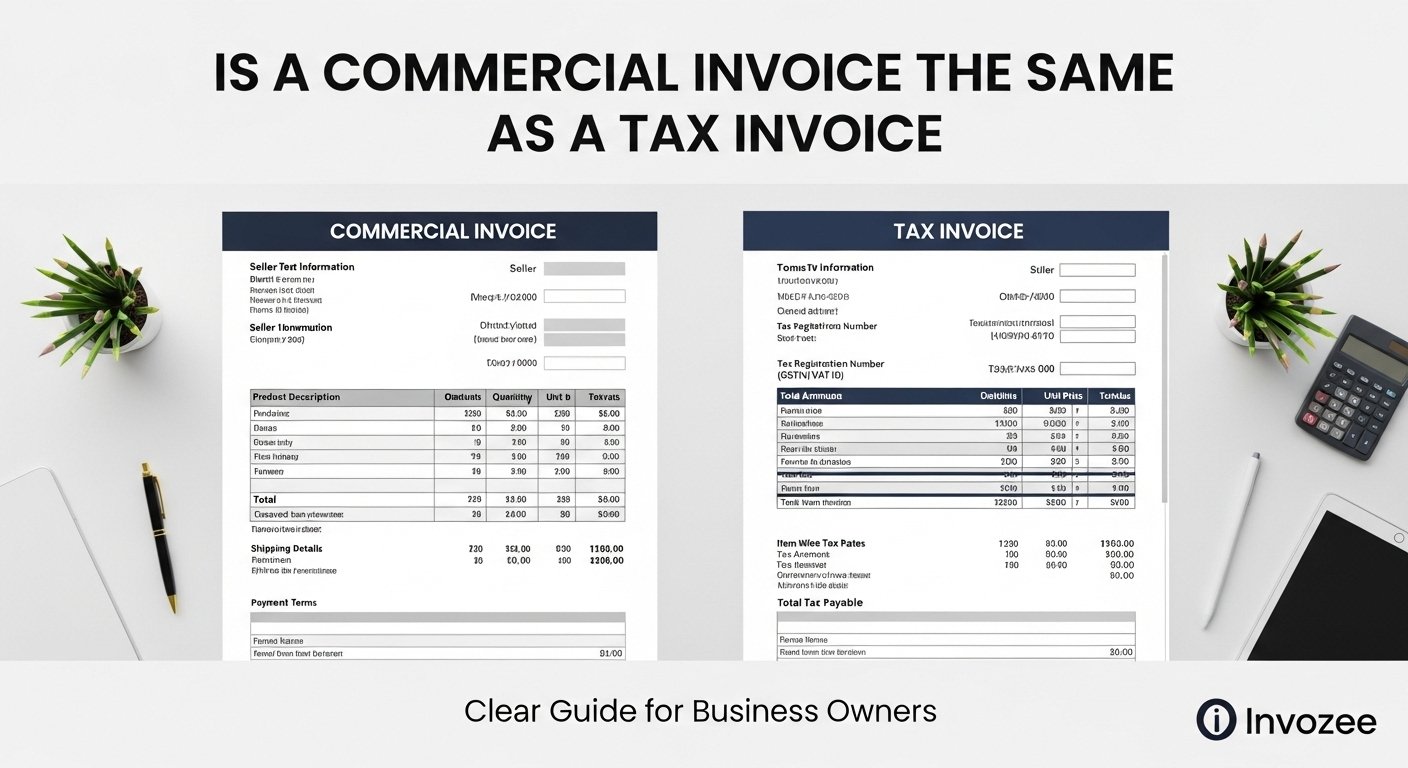

The short answer is no. A commercial invoice and a tax invoice are related but not identical. Once you see how each one works, it becomes much easier to decide what you actually need for a specific sale.

Key takeaways

- A commercial invoice is used for international shipping and customs, not for submitting tax returns.

- A tax invoice is used to record taxable sales in your accounting system and for reporting VAT or sales tax.

- Domestic sales usually only need a tax invoice, while export shipments often need a commercial invoice and sometimes a tax invoice as well.

- Invozee helps you keep both types of documents consistent so clients, customs and accountants all get what they need without confusion.

- The short answer to “is commercial invoice same as tax invoice”

- What a commercial invoice is used for

- What a tax invoice is used for

- Why people confuse commercial and tax invoices

- When you need each document in real scenarios

- How Invozee keeps both types of invoices simple

- Frequently asked questions

The short answer to “is commercial invoice same as tax invoice”

The honest, practical answer is:

- No, they are not the same document.

- They sometimes contain similar information, but they speak to different audiences.

- You might need only one of them, or in some cases both.

The commercial invoice speaks to customs and carriers, while the tax invoice speaks to your tax authority and your accounting system. Once you remember that difference, choosing the right document becomes much easier.

What a commercial invoice is used for

A commercial invoice is created when goods move from one country to another. It tells customs what is inside the shipment, how much it is worth and who is sending and receiving it. The goal is to make import and export checks clear and predictable.

Key details on a commercial invoice

- Exporter and importer names and addresses

- Invoice number and date

- Description of goods, quantities and unit values

- HS codes or tariff codes

- Total value and currency

- Country of origin of the goods

- Delivery terms and Incoterms that define who pays duties and freight

If this information is missing or unclear, customs can delay the shipment or ask for extra documents, which is why it is worth taking a few minutes to prepare the commercial invoice properly.

What a tax invoice is used for

A tax invoice is focused on the financial side of the sale. It records the money you charged, the tax you collected and the details your customer and accountant need for their own records.

Key details on a tax invoice

- Your business name, address and tax registration numbers

- Customer name and billing address

- Invoice number, issue date and due date

- Line items with quantities, prices and totals

- Tax rates and tax amounts, with a clear total to pay

- Payment terms and preferred payment methods

Different countries set their own rules for what a tax invoice must show. For example, guidance from sources like the IRS small business section and VAT authorities often explain what they expect to see in your records.

If you want help with layout and wording for service based work, you can also explore our guide on how to create an invoice for freelancers.

Why people confuse commercial and tax invoices

So why do so many people still ask if a commercial invoice is the same as a tax invoice. There are three common reasons.

The word “invoice” feels like it should be one thing

In day to day business, you talk about sending an invoice and getting paid. Nobody says “I will send you a tax invoice and a commercial invoice” in a casual chat. Because the word is the same, it is easy to assume the document is the same as well.

Some details overlap on both documents

Both documents show who is selling, who is buying and what is being sold. If you glance quickly at each one, they can look almost identical. The real difference is in the purpose and the extra fields that customs or tax authorities care about.

Many businesses still rely on manual templates

When invoices are built in Word or Excel from old copies, it is very easy to rename a file and reuse it for a different purpose. Over time this leads to mixed formats and unclear records. A dedicated invoicing tool makes it easier to keep clear templates for each use case.

When you need each document in real scenarios

Now that you know the theory, it helps to walk through a few practical examples and answer whether you need a commercial invoice, a tax invoice or both.

Scenario 1: Local service project

You are a consultant helping a client in the same city. You deliver strategy sessions and reports, with no physical goods crossing a border.

- Commercial invoice: not needed, because there is no international shipment.

- Tax invoice: needed, to show the service, the tax charged and the total to pay.

Scenario 2: Domestic sale of products

You run an online store that ships only within your country. Parcels move inside a single tax system.

- Commercial invoice: usually not required for domestic shipments.

- Tax invoice: required so your customer and your accountant can record the purchase.

Scenario 3: Exporting goods to another country

You sell physical products from your home country to customers overseas. Parcels cross borders and customs must understand what is being imported.

- Commercial invoice: required so customs can classify the goods and calculate duties.

- Tax invoice: often created as well, especially if you need to record the sale for VAT or sales tax, even if you later treat it as zero rated.

Scenario 4: Subscription based digital product

You sell a monthly software subscription to users around the world. No parcel is shipped; access is digital.

- Commercial invoice: not normally required, because customs are not involved.

- Tax invoice: required, especially when handling VAT or similar taxes on electronic services.

For more help on choosing the right structure and template, you can explore our free invoice templates for 2025, which give you practical formats to start from.

How Invozee keeps both types of invoices simple

Once you understand that a commercial invoice is not the same as a tax invoice, the next step is to keep your workflow simple enough that you can follow it even on busy days. That is where a focused invoicing tool makes a real difference.

Separate templates, one source of truth

In Invozee, you can store all your customer, item and tax information in one place and then create different templates for different purposes. For example, one layout for everyday tax invoices and another layout that includes customs friendly details for export orders.

Cleaner records for clients and accountants

When every invoice uses clear fields and consistent wording, clients approve faster, and accountants spend less time chasing missing information. If you follow a simple structure inspired by trusted examples, such as those shared by platforms like HubSpot, you quickly build a set of templates that work well across clients and countries.

Less time formatting, more time on real work

Instead of fixing alignment and totals in spreadsheets, you spend a few seconds adding line items and reviewing the final document. Invozee takes care of the math and numbering, so you can focus on delivering the work rather than maintaining the paperwork.

Stop guessing which invoice to send

Use Invozee to create clear tax invoices for your everyday work and structured documents for export orders when needed. Keep everything in one simple dashboard and download clean PDFs in a few clicks.