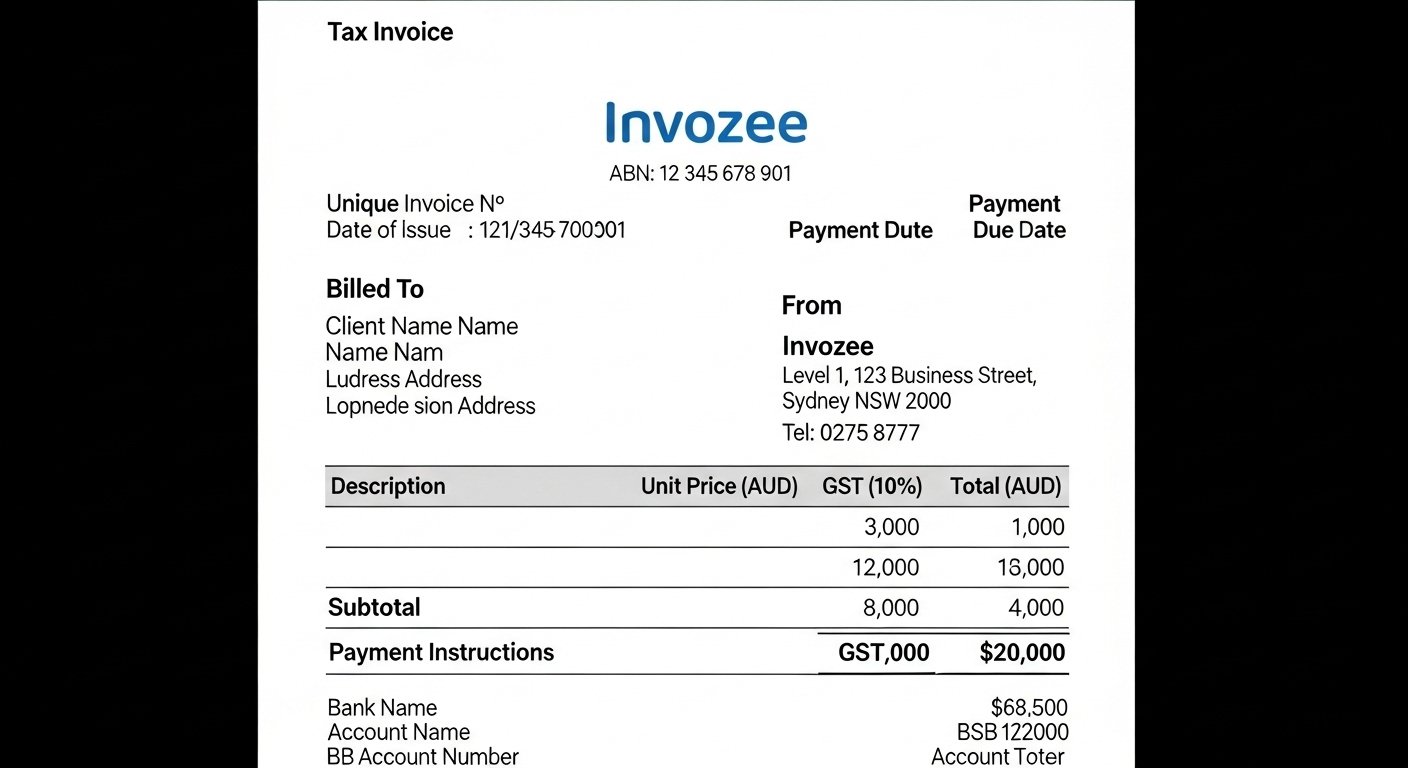

Invoice Template Australia: A Simple and Compliant Layout

Looking for a simple, compliant invoice template in Australia? You've come to the right place! This guide shows you how to create an invoice that meets the Australian tax requirements and makes billing easy for both you and your clients.

Whether you are a freelancer, small business owner, or just looking to streamline your billing process, using an Australian invoice template is essential for maintaining compliance with local tax laws. In this blog post, we will provide you with a clear overview of how to create an invoice template that covers all the necessary details.

Key takeaways

- A compliant invoice template includes details like your ABN, GST rate, and payment terms.

- The template should have clearly defined sections such as client details, product/services, totals, and tax rates.

- Invozee simplifies this by allowing you to save and reuse your templates with the correct formatting and tax codes.

- Ensure your template meets GST or other relevant tax requirements in your area to stay compliant.

What should an Australian invoice template include?

An Australian invoice template must include several important details to ensure that it complies with tax regulations. These details should cover your business's and your client’s information, as well as clear descriptions of what you are charging for. Here's what to include:

- Your Business Details: Include your business name, ABN (Australian Business Number), business address, and contact details.

- Client Details: Include the client's full name, business name, address, and contact information.

- Invoice Number: Ensure each invoice has a unique reference number for easy tracking.

- Invoice Date: Include the date the invoice is issued.

- Due Date: Specify when payment is due for the invoice.

- Description of Products/Services: List each item or service provided along with their individual prices and quantities.

- GST Amount: Clearly indicate the amount of GST or other applicable taxes.

- Total Amount Due: Calculate the total, including taxes and other charges.

- Payment Terms: Include information on accepted payment methods and any terms for late payment.

How to design a simple invoice template

A clean, simple design will make your invoice easy for clients to read and understand. Here’s how to structure your invoice template:

1. Keep your design consistent

Use a clear, readable font like Arial or Times New Roman. Keep the font size between 10pt to 12pt for the body, and make headings or totals slightly larger or bold for emphasis.

2. Group similar information together

Place your business details and client details in separate blocks to make the information easy to find. Similarly, group the line items with the subtotal, tax amount, and total at the bottom.

3. Include payment instructions

Make it easy for your clients to pay by including clear payment methods (bank transfer, online payment links, etc.) and your payment terms. This will help reduce confusion and delay.

GST and other tax requirements

As an Australian business, you need to include the GST (Goods and Services Tax) rate on your invoices. This is a requirement if your business is registered for GST. The standard GST rate is 10%, and it should be clearly shown on your invoices.

You should also ensure that all taxable items or services have the correct GST applied, and non-taxable items are clearly marked as exempt from tax.

How Invozee simplifies invoice creation

Invozee helps you automate the invoicing process, so you can focus on your business rather than paperwork. With Invozee, you can:

- Choose from customizable templates with all the necessary fields.

- Automatically calculate GST and other tax amounts for each invoice.

- Save and reuse templates for quick and consistent invoicing.

- Track your invoices and get payment reminders.

Frequently asked questions

What is the GST rate in Australia?

The standard GST rate in Australia is 10%. This applies to most goods and services sold in Australia.

Can I customize my invoice template in Invozee?

Yes, Invozee allows you to customize your invoice template with your business details, logo, tax rates, and payment methods.

How do I add GST to my invoice in Invozee?

Simply select the GST tax code in your Invozee template, and it will automatically apply the 10% GST to your products or services as needed.