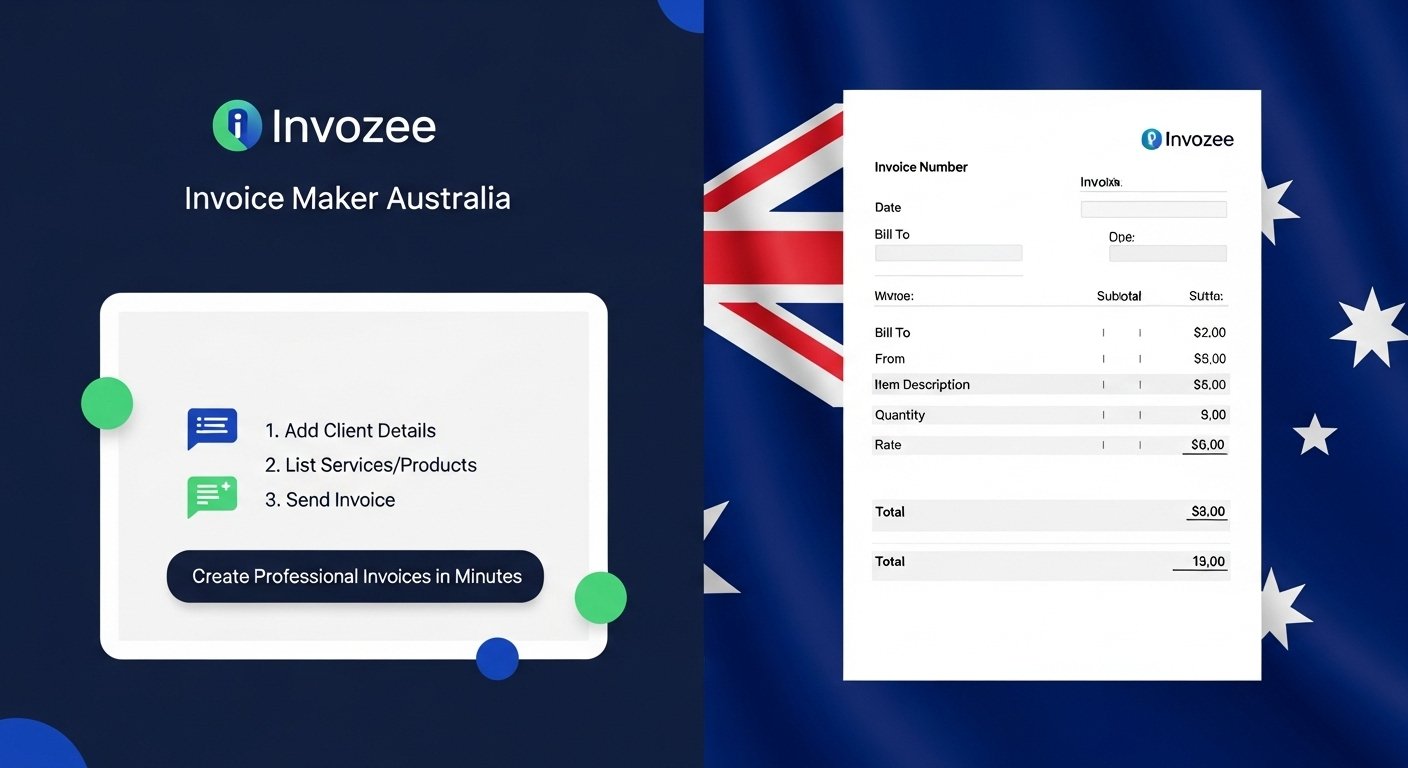

Invoice Maker Australia — Create Professional Invoices in Minutes

Published: December 31, 2025

Summary: Learn how to create professional invoices for your Australian business using an invoice maker. Save time and ensure compliance with our easy-to-use invoice generator.

In Australia, businesses must create valid invoices for their sales and transactions, especially if GST is involved. Having an efficient system for creating invoices can save you time, ensure compliance, and streamline your accounting processes. In this blog, we will explore the benefits of using an invoice maker in Australia and show you how to generate professional invoices quickly with Invozee.

What is an Invoice Maker?

An invoice maker is an online tool that allows businesses to generate invoices quickly and easily. With an invoice maker, you can create and send invoices in minutes, customize templates, and automate certain details like tax calculations and payment terms. This tool is especially helpful for small businesses and freelancers who need to keep their billing organized and professional.

Why Use an Invoice Maker in Australia?

In Australia, businesses are required to issue tax invoices for goods and services provided, especially if GST is involved. Using an invoice maker ensures that your invoices comply with Australian tax laws and contain all the necessary details. Some reasons to use an invoice maker in Australia include:

- GST Compliance: Automatically include GST in your invoices and stay compliant with ATO requirements.

- Professional Invoices: Create clean, professional invoices that reflect your business’s image.

- Save Time: Automate the process of creating invoices, saving you valuable time.

- Track Payments: Keep a record of all invoices and payments, helping you stay organized and on top of your finances.

How to Use Invozee’s Invoice Maker in Australia

Creating invoices with Invozee is quick and easy. Here’s how to use our invoice maker:

- Sign up or log in to your Invozee account.

- Enter your business information, including your ABN (Australian Business Number).

- Fill in your client’s details and the services or products you’ve provided.

- Choose the appropriate tax rate (GST) and any other charges you need to apply.

- Preview your invoice, make any necessary changes, and download it as a PDF to send to your client.

Free Invoice Template for Australian Businesses

You can download a free invoice template from Invozee to get started. It’s fully customizable and designed to meet Australian invoicing standards, ensuring that you comply with tax regulations and present a professional image.

Best Practices for Using an Invoice Maker

- Keep It Simple: Stick to clear and concise descriptions for goods and services provided.

- Always Include Tax Information: Make sure GST and other relevant taxes are clearly stated on the invoice.

- Use Payment Terms: Clearly state payment due dates and any late fees to avoid payment delays.

Frequently Asked Questions

Is using an invoice maker easy? Yes, using an invoice maker is very straightforward. Invozee’s online platform simplifies the process of creating and managing invoices.

Do I need to be registered for GST to use an invoice maker in Australia? If your business is registered for GST, using an invoice maker will help you comply with Australian tax laws. If you’re not registered for GST, you can still use the tool for generating non-tax invoices.

Can I customize my invoices? Yes, you can fully customize your invoices, including adding your business logo, choosing payment terms, and setting the correct tax rates.

Start using Invozee today to create professional invoices in minutes and streamline your billing process in Australia.