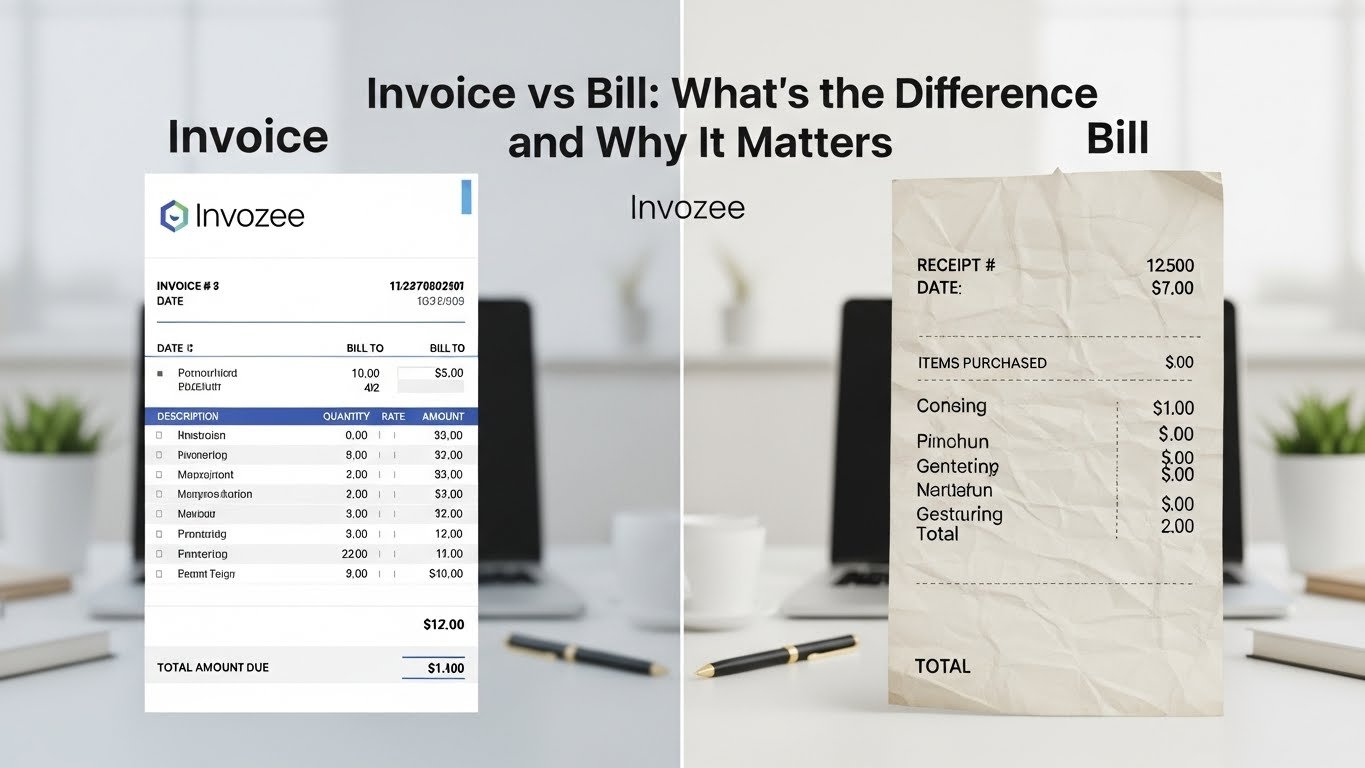

Invoice vs Bill: What’s the Difference and Why It Matters

In casual conversation, you might say you “sent an invoice” and your client might say they “paid the bill”. You are both talking about the same document, just from different sides of the table. Still, understanding how invoice vs bill works in practice can make life easier when you talk to clients, bookkeepers, and accountants.

Let’s walk through what each word usually means, how they show up in your records, and how to keep them organised without overthinking the terminology.

Key takeaways

- An invoice is typically what the seller issues; a bill is what the buyer receives.

- The document itself can look the same. The word changes with perspective.

- Your outgoing invoices to customers become their bills to pay.

- Invozee focuses on invoices you send; other tools and accounting systems help track the bills you pay.

- This guide is general information and not accounting, tax, or legal advice.

What is an invoice?

An invoice is a document you send to a customer to request payment for products or services you have delivered (or agreed to deliver). It usually includes:

- Your business name and contact details.

- Your customer’s details.

- An invoice number and dates.

- A description of what you sold.

- Prices, taxes if applicable, and the total amount due.

- Payment terms and how to pay.

In Invozee, everything you create and send to your customers is an invoice. On their side, that same document is their bill to pay.

What is a bill?

A bill is a request for payment that you receive from someone else. When your software vendor, landlord, or supplier sends you an invoice, you probably call it a bill in everyday life.

You do not usually edit bills; you pay them and record that payment. In your accounting system, bills show up as money you owe (your accounts payable), while the invoices you issue to clients show up as money they owe you (your accounts receivable).

Invoice vs bill: same document, two perspectives

The easiest way to think about invoice vs bill is to remember that it is mostly about point of view.

From your perspective as a business

- You issue invoices to your customers.

- You receive bills from your suppliers.

- Invoices represent money that should come in.

- Bills represent money that will go out.

From your customer’s perspective

- Your invoice becomes their bill.

- They add that bill to their list of payables.

- When they pay it, their bill is settled.

- On your side, your invoice is now marked as paid.

This is why you will see some software and educational content talk about invoices on the sales side and bills on the purchases side. Our own invoice vs receipt guide adds another layer by explaining how receipts fit into the picture after payment has been made.

Real world examples of invoices and bills

Let’s make this concrete with a few simple scenarios.

Example 1: You are a web designer

You build a website for a client and send them an invoice for the agreed project fee. Inside Invozee, this is recorded as an invoice you issued. Your client opens that document and calls it their bill for the website project. They pay it, and the invoice is marked as paid in your system.

Example 2: You pay for project tools

The design tool you use sends you a monthly invoice by email. You save it and refer to it as your bill for design software. In your records, it goes into expenses. For your software provider, that same document is their invoice to you.

Example 3: You run a small studio

You send invoices to clients through Invozee for retainers and projects. At the same time, you receive bills from your hosting company, subcontractors, and office landlord. Your outgoing invoices and incoming bills are different sides of the same process: money flowing in and money flowing out.

How invoices and bills show up in your records

Invoices and bills are more than just documents you email back and forth. They are also key pieces of your financial records.

In your own bookkeeping

- Invoices: sales documents that show who owes you money and why.

- Bills: purchase documents that show who you owe money to and why.

- Receipts: confirmation that a payment was made, either by you or to you.

Good record keeping helps you understand cash flow, work with your accountant, and respond if tax authorities ever ask for supporting documents. Many official tax and business resources emphasise keeping copies of both the invoices you send and the bills you pay, along with proof of payment.

Where Invozee fits in your invoice/bill workflow

Invozee is focused on the documents you send to customers. It helps you create clear, consistent invoices that are easy to understand and easy to pay. Those invoices are your customers’ bills.

Use Invozee for the sales side (your invoices)

On the sales side, Invozee helps you:

- Create templates for your services and packages.

- Keep invoice numbers consistent and easy to track.

- Send invoices in a clean, professional format. <