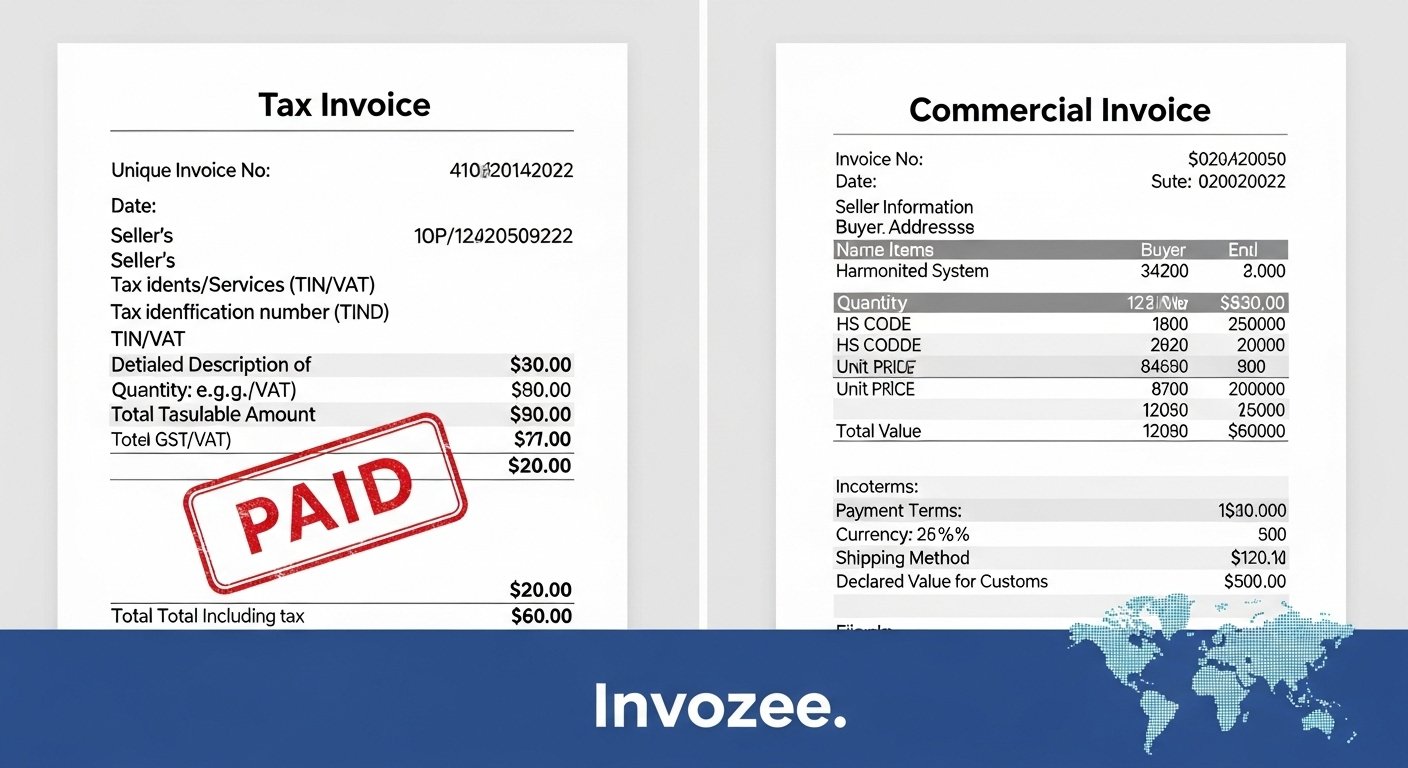

What is the Difference Between a Tax Invoice and a Commercial Invoice?

If you've ever been confused about the difference between a tax invoice and a commercial invoice, you're not alone. While both are essential for business transactions, they serve very different purposes.

In this blog, we'll explore the key differences between these two types of invoices, their individual uses, and when you should use each for your business needs.

Key takeaways

- A tax invoice is required for tax reporting and claiming tax credits, while a commercial invoice is used for international trade and customs clearance.

- Commercial invoices typically don’t include tax details, while tax invoices must clearly show tax charges.

- Each type of invoice has its specific use case depending on the nature of the transaction (local vs. international).

- Invozee helps simplify the process of generating both types of invoices, ensuring they are accurate and compliant.

What is a tax invoice?

A tax invoice is a document issued by a seller to a buyer that includes details about the goods or services sold, the tax charged on the sale, and the total amount payable. It is primarily used for tax reporting and allows customers to claim input tax credits in systems like VAT or GST.

What is a commercial invoice?

A commercial invoice is used in international trade and shipping. It provides a detailed description of the goods or services sold, including their quantity, price, and total value. It is essential for customs clearance and acts as proof of the transaction.

Key differences between tax and commercial invoices

While both types of invoices are used for business transactions, they serve different functions:

- Purpose: Tax invoices are used for tax reporting and claiming credits, while commercial invoices are used for customs clearance during international trade.

- Tax Information: Tax invoices include tax details, whereas commercial invoices generally do not.

- Use Case: Commercial invoices are used for international sales, and tax invoices are used for local transactions subject to VAT or GST.

When to use a tax invoice vs a commercial invoice

Use a tax invoice for transactions that require VAT or GST reporting or when you need to claim tax credits for business expenses.

Use a commercial invoice for international shipments and customs purposes to provide proof of the transaction and facilitate customs clearance.

How Invozee helps you manage both types of invoices

Invozee makes it easy to create both commercial and tax invoices with its customizable templates, ensuring that you stay compliant with your tax obligations and customs requirements.

Start managing your invoices with ease

Create professional, compliant tax and commercial invoices with Invozee today. Get started with our free trial.