Compliant Tax Invoice: A Simple Checklist You Can Reuse

If you send invoices regularly, you already know how important it is to get them right. A compliant tax invoice is not just a nice to have. It is the document that keeps your customer, your accountant and your tax authority on the same page.

The challenge is that requirements can feel technical and different for every country. This guide focuses on the practical side. You will see what a compliant tax invoice usually includes, how to turn that into a quick checklist and how Invozee helps you follow it without adding more work to your day.

Key takeaways

- A compliant tax invoice includes specific details about your business, your customer, the sale and the tax you charged.

- Clear structure and consistent layout make it easier for clients to approve and for accountants to use as evidence.

- You can use a simple checklist inside Invozee to make every invoice follow the same standard.

- For final rules and thresholds, always rely on your local tax authority or a qualified professional.

What is a compliant tax invoice

A compliant tax invoice is an invoice that meets the legal and tax rules in your jurisdiction. It lets the buyer and their accountant see exactly what you supplied and what tax was charged. It also gives your accountant a solid, traceable record that supports your tax returns.

The exact rules vary by country. For example, in many VAT systems businesses need tax invoices with specific wording and breakdowns for customers to claim input tax. In the United States, guidance from the IRS small business section focuses more on keeping accurate records that support reported income and expenses.

Core elements every compliant tax invoice should cover

While the fine print differs by region, most compliant tax invoices share the same core building blocks. Think of them as the non-negotiable sections your template should always include.

1. Your business identity

Your invoice should clearly show who is issuing it. This includes:

- Legal business name and trading name if they differ.

- Registered address or main business address.

- Tax identification number, such as VAT ID, GST number or TIN.

- Contact email and phone number.

- Logo in a clean, readable size for brand recognition.

2. Customer details

The tax invoice needs to identify who you billed. Add:

- Customer or company name.

- Customer billing address.

- Customer tax registration number if they are a registered business and need it on the invoice.

- A contact name or reference where helpful.

3. Invoice reference and dates

A compliant tax invoice should always be easy to find and reference later. At a minimum, show:

- A unique invoice number that follows a simple pattern.

- The invoice issue date.

- The payment due date or credit terms so expectations are clear.

4. Clear description of goods or services

Each line item on the invoice should make sense even to someone who does not know your business in depth. Include:

- Plain language description of the product or service.

- Quantity, hours or units.

- Unit price.

- Line total before tax.

5. Tax breakdown

The way you present tax is one of the most important parts of compliance. Typical elements include:

- Tax rate applied to the sale.

- Tax amount in currency.

- Whether amounts are shown inclusive or exclusive of tax.

- Notes if some items are zero rated or exempt.

6. Totals and payment information

Finally, show the values that matter most to your customer and their finance team:

- Subtotal before tax.

- Total tax charged.

- Total amount payable.

- Payment instructions and accepted methods.

If you are building your invoice layout from scratch, it helps to look at practical examples in trusted guides, such as HubSpot’s invoice tutorials, then refine them into your own template inside Invozee.

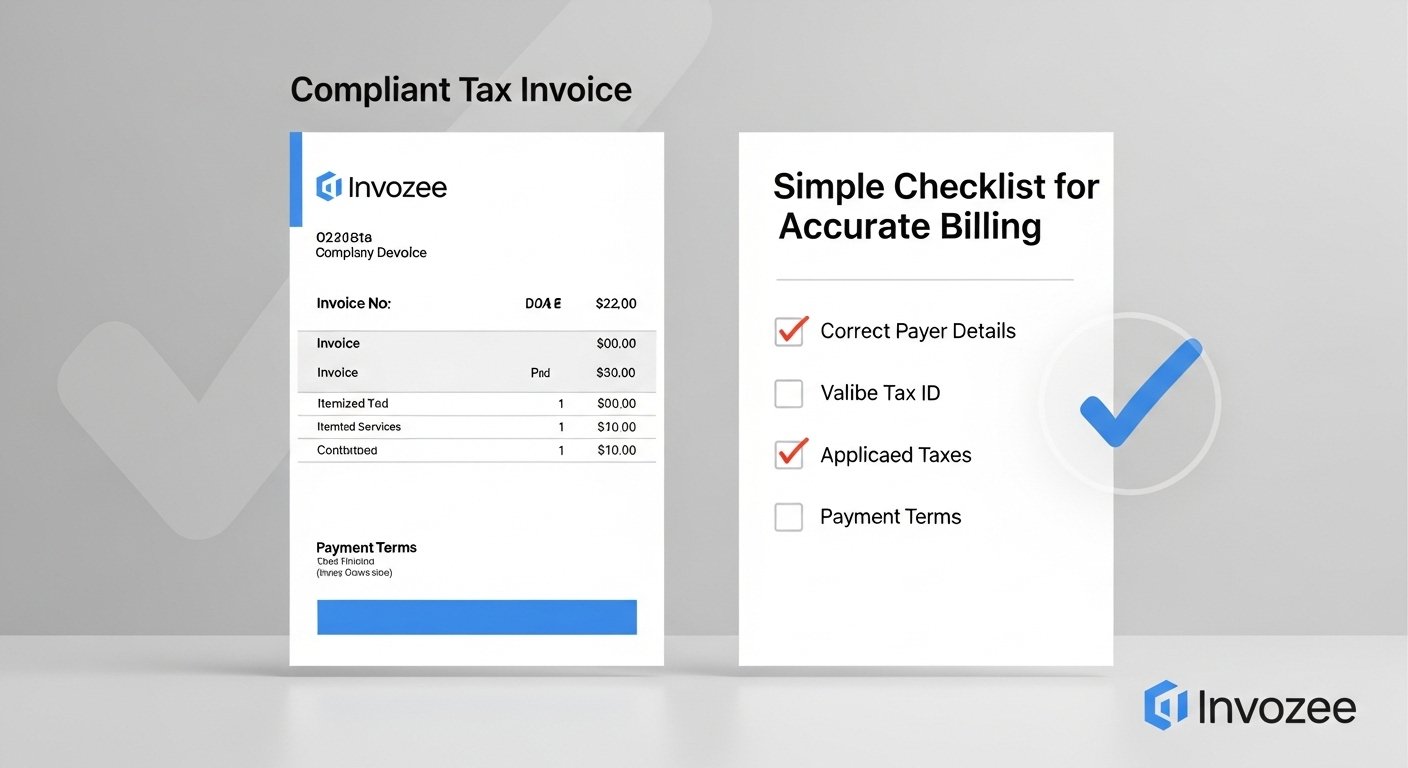

Practical checklist for your next compliant tax invoice

To make this easier to apply, you can treat the compliant tax invoice as a short checklist you run through in Invozee each time you create a new document.

Compliant tax invoice checklist

- Your business name, address and tax ID are visible and correct.

- The customer name and billing address match your agreement or purchase order.

- The invoice has a unique number and an issue date.

- Each product or service has a clear description, quantity and unit price.

- Line totals add up to the subtotal.

- Tax rate and tax amount are clearly labeled.

- The final total to pay matches the numbers above.

- Payment terms and methods are easy to find.

- The layout is consistent with your previous invoices.

If you have not yet decided on your layout, take a look at our free invoice templates for 2025 and adapt one of the structures there into a compliance-focused template that suits your region.

UX tips so clients understand your invoice at a glance

Compliance is not just about data. It is also about how easy it is for people to read that data without confusion. A user friendly tax invoice is more likely to be processed quickly and less likely to trigger disputes.

Keep related information grouped together

Place your business block, customer block, invoice identity and totals in consistent spots on every invoice. When a finance team sees your invoices often, this familiar layout saves them time and reduces questions.

Highlight the total and due date

Make the total amount and the payment due date easy to see with subtle emphasis. You can use slightly larger text or bold labels. There is no need for bright colours that could make the invoice harder to print or copy.

Use plain language in descriptions and notes

Avoid internal jargon. Use words your customer would use when they describe your work to their colleagues. If you add a note at the bottom of the invoice, keep it short and focused on what the customer needs to know.

Align numbers so they are easy to scan

Finance teams spend a lot of time scanning numbers. Neat columns for quantity, price, tax and totals make your invoice easier to check. This small design detail can speed up approvals and reduce errors.

How Invozee helps you stay compliant day after day

Creating one compliant tax invoice is not hard. The real challenge is doing it the same way every week while you juggle sales, delivery and admin. That is where a dedicated invoicing tool like Invozee becomes useful.

Templates that lock in your compliance basics

In Invozee you can set up a template that already includes all the sections described above. Your business identity, tax ID, branding and preferred wording are saved once. Every new invoice then follows the same structure by default.

Reusable client and product details

Instead of retyping customer names and line descriptions, you store them in Invozee. This reduces typing errors and helps keep descriptions consistent. For freelancers and small teams, our invoice guide for freelancers is a good companion if you are defining your descriptions for the first time.

Cleaner history for accountants and audits

Invozee keeps past invoices in a single, searchable place. When an accountant asks for a set of invoices to support a tax return, you can export or share them quickly. If a tax authority ever reviews your records, having consistent, well structured invoices becomes a real asset.

Turn compliance into a simple habit

Build your compliant tax invoice template once in Invozee, then focus on the work that brings in revenue while Invozee keeps every new invoice aligned with your checklist.