ATO Tax Invoice Template — How to Create and Use It for Compliance

Published: November 26, 2025

Summary: Learn how to create an ATO-compliant tax invoice template for your business. This blog explains the necessary components and best practices to ensure your invoices meet Australian tax regulations.

When running a business in Australia, it’s crucial to ensure your invoices comply with the Australian Taxation Office (ATO) requirements. An ATO tax invoice template simplifies this process, ensuring that your invoices meet the legal standards for GST (Goods and Services Tax) reporting and record-keeping. This blog will guide you through creating a compliant tax invoice template and provide best practices to streamline your invoicing process.

What is an ATO Tax Invoice?

An ATO tax invoice is a document issued by a business to a customer, detailing the goods or services provided and the tax applied to those goods or services. According to the Australian Taxation Office (ATO), businesses that are registered for GST must issue tax invoices to clients for sales where GST is applicable. These invoices must include certain details to ensure compliance with ATO regulations.

Why Do You Need an ATO Tax Invoice Template?

Using a standardized tax invoice template helps businesses comply with the ATO’s strict invoicing requirements, ensuring consistency and accuracy. A tax invoice template also saves time, reduces errors, and provides a professional appearance for your business.

Key Components of an ATO Tax Invoice Template

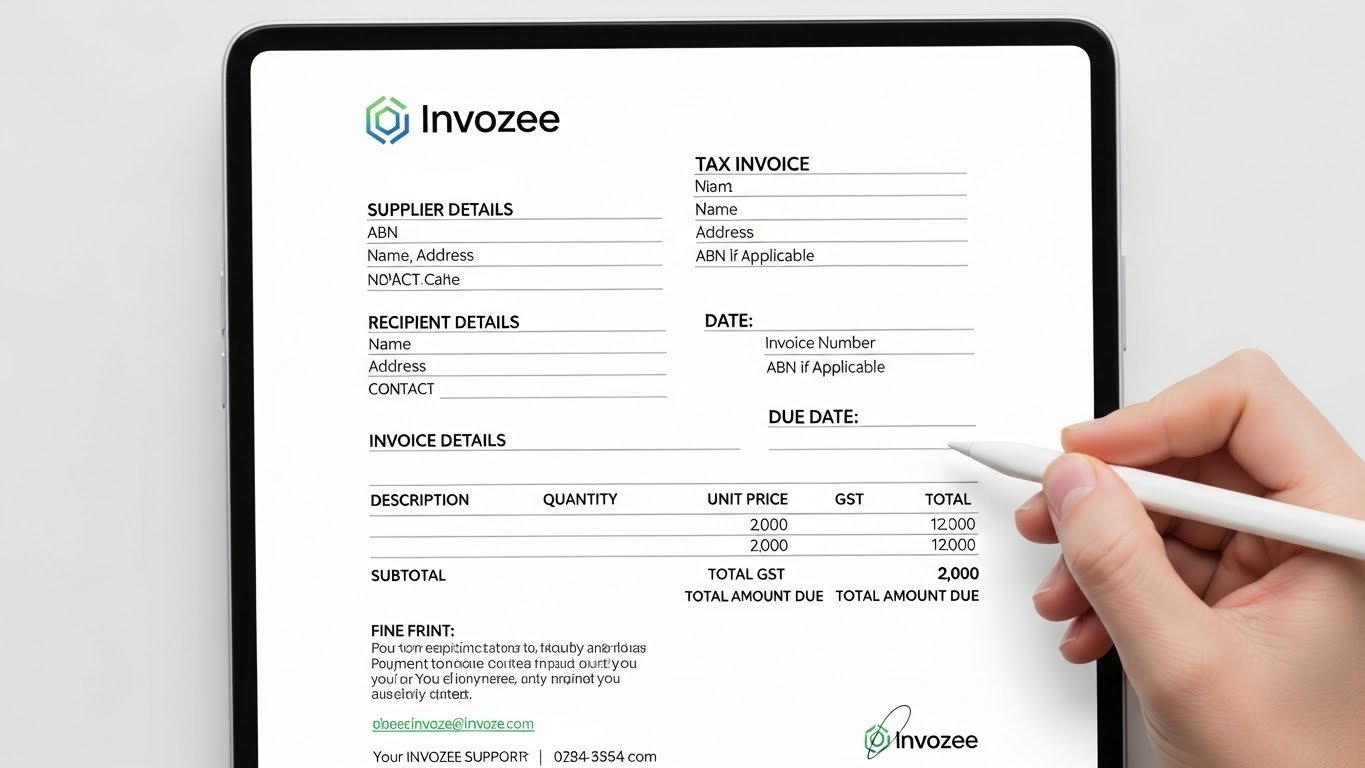

The following are the mandatory components that must be included in an ATO-compliant tax invoice:

- Invoice Number: A unique identifier for each invoice to help track and organize invoices.

- Seller’s Information: The business name, address, and Australian Business Number (ABN) of the seller.

- Buyer’s Information: The buyer’s details, including name and address.

- Invoice Date: The date the invoice was issued.

- Description of Goods or Services: A clear description of the products or services provided, including quantities and unit prices.

- GST Amount: The GST amount charged on the sale, showing how it’s calculated.

- Total Amount Due: The total amount due, including GST and any other charges or discounts.

- Payment Terms: The payment method, due date, and any late payment fees, if applicable.

How to Create an ATO Tax Invoice Template Online

Creating an ATO-compliant tax invoice is simple with Invozee. Just follow these steps:

- Step 1: Sign up or log in to Invozee.

- Step 2: Enter your business and customer details, including your ABN.

- Step 3: Add the description of goods or services provided and the applicable GST rate.

- Step 4: Generate the invoice using Invozee’s template generator and download the invoice in PDF format for distribution.

Best Practices for ATO Tax Invoices

- Ensure Accuracy: Double-check all details, including pricing, GST, and customer information.

- Send Invoices Promptly: Issue invoices immediately after the sale to avoid payment delays.

- Retain Copies: Keep a copy of every invoice for your financial records and tax purposes.

Frequently Asked Questions

What is the difference between a regular invoice and an ATO tax invoice? A regular invoice doesn’t necessarily include GST or comply with ATO reporting requirements. An ATO tax invoice must include specific details like GST and the seller’s ABN.

Can I use an ATO tax invoice template online? Yes, Invozee allows you to create and download a compliant ATO tax invoice template in just a few clicks.

Do I need to issue a tax invoice for every sale? If you are registered for GST and the sale involves GST, you are required to issue a tax invoice for that transaction.

Start creating your ATO-compliant tax invoices today with Invozee.